“Cord-cutting” is a fast-growing trend among US residents. It involves “cutting the cord” on high-cost pay-TV options, including cable TV and satellite TV.

위성tv와 cabletv와 같은 가격이 높은 페이tv의 옵션상품을 해지하는것을 포함하는 것이다.

Cord cutters aren’t ditching TV altogether. 코드커팅은 TV를 내 팽겨치는 것이다.

Instead, they’re shifting to lower-cost online streaming options, like on-demand giant Netflix and Google’s YouTube TV.

고가의 상품을 사는 대신에 넷플릭스나 구글 유투브TV와 같은 저가의 스트리밍 상품으로 전환하는 것이다.

Although cord-cutting is still in its infancy compared to traditional methods for viewing content, its rapid and expanding growth in the past several years means there are plenty of cord-cutting stats and trends available in 2023. Here are the most startling[amazing, surprising] and interesting cord-cutting facts for the current year and beyond.

코드커팅이 비록 콘텐츠를 시청하는 전통적인 방식에 비유해 아직 유아기이지만 과거 수년이 걸쳐 그속도와 변화범위는 2023년 매우 유용하고 현재와 그 이후를 추측하더라도 매추 놀랍고 흥미로운 일일듯 하다.

1. Major cable providers collectively lost 6 million pay-TV subscribers each year between 2019 and 2022 메이저케이블tv는 2019년~2022년 매년마다 6백만 유료가입자를 잃어버렸다.

Cord-cutting is responsible for leading cable TV providers losing millions of customers they can’t seem to win back. In fact, traditional pay-TV providers lost around 6 million pay-TV subscribers each year from 2019 to 2022. This trend seems set to continue, with 2.3 million customers leaving in the first quarter of 2023 alone.

코드커팅은 주요 케이블TV 프로바이더들이 수백만 고객들 다시는 재림할 수 없는것처럼 보이도록 했다. 사실상 전통적인 유료TV 제공업자들은 2019년부터 2022년 매년 6백만명의 유료TV가입자가 탈퇴했다. 이러한 트렌드는 2023년 1분기만 따로 떼어 보아도 2.3백만의 고객을 잃어버렸다.

Most cord-cutters are not just ditching live TV for all on-demand, however. The majority are instead moving to all-digital live TV streaming services, such as Sling TV, YouTube TV, fuboTV, and Hulu + Live TV.

보통의 코드커팅은 여러방면의 on-demand tv만을 따로 이탈시킨건 만은 아니다. 그러나 대다수는 슬링tv, 유투브tv, fubo tv, hulu, live-TV와 같은 스트리밍 서비스에 모든 디지털라이브 형태로 이동했다.

The largest traditional cable TV providers experiencing subscriber losses include:

- Comcast: This company had 18.55 million video customers in Q3 2021. However, Q1 of 2023, it lost more than 600,000 and now sits at around 15.5 million customers. 2021년 3분기에 18백만5천명의 가입자가 있었지만 2023년 1분기에는 6십만 가입자를 잃어버렸고 현재는 15백만5천명의 고객을 확보하고 있다.

- Verizon: Subscriber numbers for this company have decreased every quarter since Q4 2016. The company lost more than 76,000 Fios TV subscribers in Q1 2023 alone and now sits at around 3.16 million overall — less than half of what it had just a few years ago.베리즌의 가입자수는 2016SUS 매분기 감소해왔다. 2023년에 1분기에만 7만6천명 이상의 가입자가 이탈했고 전체 분기별로는 몇년전의 수치였던 3백만1천6백면의 가입자에 정체돼있다.

Charter: This organization is now losing tens of thousands of video customers each year. Its CEO blames higher carriage fees[유료TV가입자로부터 받는 수익] imposed by programmers as a key trigger for customers who are moving on to cord-cutting services. This network has an abysmal[지독한] 2023 so far, with over 230,000 customers cancelling their pay TV subscription in the first quarter — in other words, the company is losing subscribers twice as quickly as it did last year. 챠터사는 매년마다 비디오 고객을 수만명의 가입자를 사라지고 있다. 챠터 CEO는 유료채널사업자로부터 코드커팅으로 이동하는 고객들에세 주요 트리거요인으로 플로그래머는 아마도 프로그램 제작자가 받는 carriage fees가 더 높아지는 요인을 꼽고 그 비용상승에 비난을 가했다. 챠터는 2023년 1분기에 그들의 유료기입자수는 23만명이 가입을 포기할 만큼 2023년 매우 지독한 상황이었다.

- DirecTV (satellite): This AT&T-owned company lost an estimated 500,000 satellite TV subscribers in Q3 2022. Believe it or not, this is actually an improvement, with Q1 of 2022 seeing the company lose over 800,000. 위성TV사중 AT&T는 2022년 3분기에 위성TV가입자의 50만명 정도의 가입자를 이탈했다. 믿든 믿치 않든 실제로 알려진것보다는 더하겠지만 2022년 1분기에 8십만명 이상의 가입자를 잃은 것으로 예측된다.

- Dish Network: The second-largest cable TV provider in the US has also seen its customer share dip. Dish Network lost 268,000 net pay-TV subscribers in Q4 2022, a slight reduction since the previous quarter. 미국에서 두번째로 큰 케이블tv인 Dish network는 고객의 빠른 침체를 경험했었고 디시네트웍스는 전분기이래 조금씩 삭제를 했지만2022년 4분기에 26만 8천명의 가입자를 잃어버렸다.

This bloodletting is expected to continue unabated[without any reduction in intensity or strength] for the time being. Even Comcast—which has experienced unquestionably the largest loss of cable TV subscribers of the bunch—is not optimistic about its pay-TV prospects, though it has big plans for the future of streaming. 아마도 이 출혈은 당분간 지속하여 더욱더 감소할 것이다. 의심할여지 없이 케이블tv 가입자들의 커다란 손실은 아마도 유로 tv예상에 있어서도 그렇게 낙관적이지 않을 것이다. 비록 스트리밍의 미래라는 큰 그림측면일지라도

Many Americans still maintain both traditional TV and cord-cutting services, however. As of 2019, 43% of Americans had both pay-TV and streaming video-on-demand (SVOD) subscriptions. 많은 미국인들은 전통적인 tv나 코드커팅서비스에 있어서 2019년 이래도 미국인들이 유료tv와 SVOD가입자들의 43%에 있어서는 아직도 유지할 것이다.

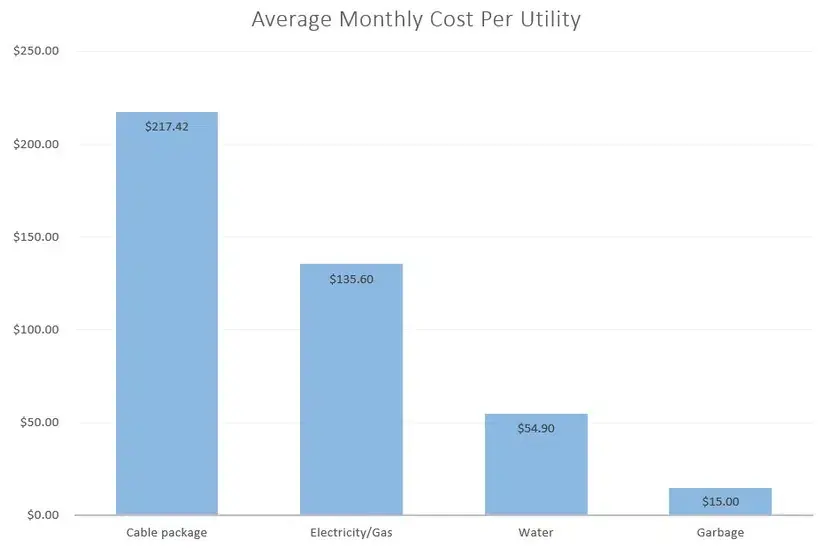

2. The average monthly cable TV bill is now over $200 per month

According to the FCC’s 2018 Report on Cable Industry Pricing (the latest as of this time of writing), the average cost of expanded basic cable services was just over $73.08. That number, however, does not include the cost to purchase or rent equipment from cable TV providers, nor does it include the cost of taxes and fees. Now, it’s worth bearing in mind that this data is several years old, and the TV landscape has changed dramatically since then. In June 2022, Allconnect released a report claiming that the average cable bill was $217.42 per month — more than all other utility bills combined.

FCC의 2018년 리포트에 따르면 케이블 산업의 가격정책에 따르면 확장된 기본 케이블요금은 73달러를 넘어설것이다. 그 금액은 어쨌거나 케이블사업자자로부터 장비를 임대하거나 구매비용을 포함하는 것이 아닌 요금과 세금 비용을 포함하는 것 또한 아닌 것이다. 이제 그 데이타는 수년치에 이르고 TV의 구매 환경은 그때부터 드라마틱컬리 변하여 왔다. 2022년 6월에 Allconnect는 모든 다른 상품의 결합으로 217달러에 이르렀다고 리포트는 말한다.

Many cord cutters instead opt for a live TV streaming service, such as YouTube TV, Hulu with Live TV, or Sling TV, which cost a fraction of that and don’t come with the added fees. 많은 코드 커터즈들은 유투브나 Hulu나 슬링같은 스트림밍 서비스 대신에 오히려 추가요금으로 갈등을 가져올 수 있다.

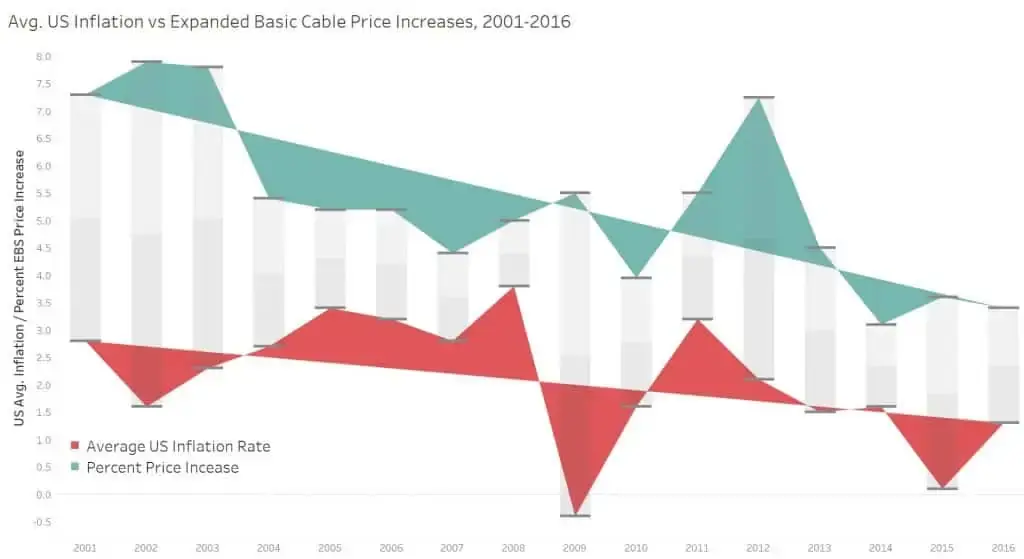

3. 2009 was the absolute worst year for traditional cable TV subscribers

A combination of price increases and decreasing wages led to 2009 being the worst year in the 2000s for cable TV subscribers. Riding on the downwind of the housing market crash, there was a 7 percentage point gap between wage increases (negative 1.5%) and expanded basic cable price increases (5.5%). It wasn’t the only year with a huge gap (2002 saw a 6.9 percentage point gap, for example), but it was the only year where that gap was highlighted by wage decreases, versus just smaller percentages of wage growth.

가격의 결합은 결국에 요금을 인상하고 2000년대 케이블tv 가입자들에게 2009년대에 최악의 임금을 감소하게 되었다. 주택시장의 충격과 붕괴로 임금상승율과 확장된 기본케이블요금의 증가사이에 7%포인트 갭이 존재한다. 큰 격차가 있었던 유일한 해는 아니었지만(예를 들어 2002년에는 6.9% 포인트의 격차가 있었습니다), 임금 증가율이 더 작은 것에 비해 임금 감소로 그 격차가 강조된 유일한 해였습니다.

As expected, we witnessed similar issues with inflation. There was a 6.9 percentage point spread between price increases and inflation in 2009 (and a 6.3 percentage point spread in 2002). 예상한 대로 우리는 인플레이션과 관련해 비슷한 문제를 목격했습니다. 2009년에는 물가상승률과 인플레이션 간 격차가 6.9%포인트(2002년에는 6.3%포인트)였다.

Wages and price increase percentages tend to be much closer together year-over-year. However, there is a promising trend we’ve seen happening with inflation, wages, and expanded basic cable price increases: the gap is tightening up each year. Again, this is expected given wages and inflation are tied, but there are two takeaways as well, one negative, one positive. 임금과 물가 인상률은 전년 대비 훨씬 더 가까운 경향이 있습니다. 그러나 인플레이션, 임금, 기본 케이블 가격 인상 확대로 인해 긍정적인 추세가 나타나고 있습니다. 그 격차는 매년 좁혀지고 있습니다. 다시 말하지만, 이는 임금과 인플레이션이 묶여 있다는 점을 고려할 때 예상되는 것이지만 두 가지 시사점도 있습니다. 하나는 부정적이고 다른 하나는 긍정적입니다.

Negative: Inflation and US wages always fall well behind traditional price increases. As such, Americans putting an ever-increasing share of their wages toward traditional cable TV. 인플레이션과 미국 임금은 항상 전통적인 물가 인상보다 훨씬 뒤처집니다. 따라서 미국인들은 전통적인 케이블 TV에 점점 더 많은 임금을 지불하고 있습니다.

Positive: The gap between inflation/wages and price increases is decreasing overall. Outliers like 2009 exist, but the overall average spread is declining. If trends continue, the average gap between price increases and wage/inflation increases could be around 0.6%. 물가상승률/임금과 물가상승률의 격차는 전반적으로 줄어들고 있다. 2009년과 같은 이상값이 존재하지만 전체 평균 스프레드는 감소하고 있습니다. 이러한 추세가 지속된다면 물가 인상과 임금/인플레이션 인상 간의 평균 격차는 약 0.6%가 될 수 있습니다.

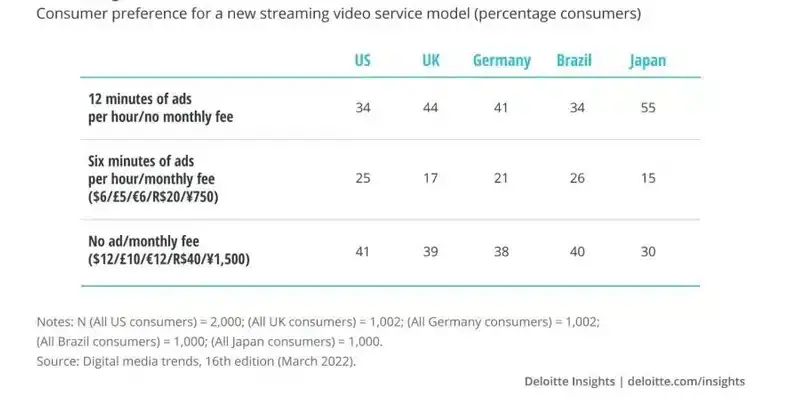

4. Ads are becoming part of the streaming landscape

One of the biggest benefits of streaming services is that they greatly reduce the number of ads you see. However, as the price of these subscriptions increase, consumers are becoming more willing to tolerate ads in exchange for cheaper (or even free) TV. 스트리밍 서비스의 가장 큰 장점 중 하나는 표시되는 광고의 수를 크게 줄여준다는 것입니다. 그러나 이러한 구독료의 가격이 상승함에 따라 소비자는 더 저렴한(또는 무료) TV를 대가로 광고를 기꺼이 참고 시청하게 되었습니다.

Deloitte’s 2023 Digital Media Trends survey found that around 60 percent of respondents used a free, ad-supported streaming service, with 40 percent claiming that they watch more ad-supported content than they used to.

Ad-tolerance is also a huge issue. The 2022 report found that users in the US would rather pay $12 to remove all ads than sit through 12 minutes of ads in exchange for watching for free. 광고 참고보는 것은 큰 문제입니다. 2022년 보고서에 따르면 미국 사용자는 무료로 시청하는 대가로 12분 동안 광고를 시청하는 것보다 12달러를 지불하고 모든 광고를 제거하는 것을 선호하는 것으로 나타났습니다.

5. Live TV services come in and out of style

As subscribers abandon their traditional pay-TV providers, they’re now going into the open arms of live TV streaming services. Whether you call them “IPTV” (though that term is more regularly applied to illegal live TV streaming options) or Virtual Multichannel Video Providers (vMVPDs), there are now a handful of internet-based services on the market designed to replace cable and satellite TV. 가입자가 전통적인 유료 TV 제공업체를 포기함에 따라 그들은 이제 라이브 TV 스트리밍 서비스를 이용하게 되었습니다. "IPTV"(이 용어는 불법 라이브 TV 스트리밍 옵션에 더 일반적으로 적용되지만) 또는 가상 다중 채널 비디오 제공업체(vMVPD)라고 부르든 현재 시장에는 케이블 및 위성을 대체하도록 설계된 소수의 인터넷 기반 서비스가 있습니다. TV.

Subscriber counts for the most-used cable TV replacers include:

- YouTube TV: Around 6.3 million subscribers as of Q1 2023 (an increase of ~300,000 since Q4 2022)

- Hulu + Live TV: 4.4 million subscribers Q1 2023 (a drop of around 100,000 from the previous quarter)

- Sling TV: 2.1 million subscribers as of Q1 2023, (down 230,000 since Q4 2022)

- FuboTV: 1.285 million subcribers, up from 947,000 in Q4 2022. That’s a 22 percent increase year-on-year.

- Philo: Over 800,000 subscribers as of Q1 2021 (an increase of ~750,000 since 2018)

Other services exist in this space, although their subscriber numbers are difficult to come by. The most notable is Vidgo. As for Philo, its numbers are also not regularly reported because, like Vidgo, the service is not publicly traded or part of a publicly-traded company and is not required to report that kind of data. 이 공간에는 다른 서비스도 있지만 가입자 수는 파악하기 어렵습니다. Philo의 경우가장 주목할만한 것은 Vidgo입니다. Vidgo와 마찬가지로 이 서비스도 공개적으로 거래되지 않거나 공개적으로 거래되는 회사의 일부가 아니며 그러한 종류의 데이터를 보고할 필요가 없기 때문에 그 수치도 정기적으로 보고되지 않습니다.

6. Some live TV service prices are up over 100% in two years

Even as cord-cutting options for live TV slowly make their way to market, their prices have gone up remarkably in the past few years. Almost every live TV streaming service that’s been on the market for more than a year has experienced at least one price increase. Most have imposed multiple price increases since launching. 라이브 TV용 코드커팅 옵션이 서서히 시장에 출시되고 있음에도 불구하고 가격은 지난 몇 년 동안 눈에 띄게 올랐습니다. 시장에 출시된 지 1년이 넘은 거의 모든 라이브 TV 스트리밍 서비스는 적어도 한 번의 가격 인상을 경험했습니다. 대부분은 출시 이후 여러 차례 가격 인상을 실시했습니다.

Almost every live TV streaming service increased prices in 2020, with one major price increase that occurred at the start of 2021, and another increase mid-2021. 거의 모든 라이브 TV 스트리밍 서비스는 2020년에 가격을 인상했으며, 2021년 초에 한 번 큰 가격 인상이 있었고, 2021년 중반에 또 다른 가격 인상이 있었습니다.

- DirecTV Stream: After phasing out its AT&T TV Now service, AT&T rolled its cord-cutting option into its broader AT&T TV offering. That also came along with a price increase that saw the base price rise from $65 per month to $69.99 per month. Now, it sits at $74.99 per month.

- YouTube TV: Google increased the price of its single live TV streaming package from $40 to $49.99 per month in 2019, and then up to $64.99 per month in 2020. In April 2023, this jumped 12 percent to $72.99 per month.

- Philo: Philo technically didn’t raise prices in 2019, but it did drop its $16 per month plan, leaving just its higher-priced $20 plan. However, on 8 June 2021, the company raised the cost of this package to $25.

- FuboTV: Every package available through fuboTV received a $10 per month increase in 2019, starting with its “Fubo” package which jumped from $44.99 per month to $54.99 per month. The company then reorganized its package offering in 2020, and again in early 2021 that resulted in the base price rising to $64.99 per month. In 2022, this increased a further $5 to $69.99 per month, then to $74.99 per month in early 2023.

- Hulu + Live TV: Hulu increased prices on its Live TV service in late 2019 by $10 per month, raising it from $44.99 to $54.99 per month. Then in 2020, it increased prices again to $64.99 per month. In October 2022, the company raised the cost of its ad-supported plan to $7.99 per month, with the ad-free tier now costing $14.99 per month. The Live TV plan shot up two more times and is now more expensive than its rivals at $82.99 per month (though this also includes ESPN+ and Disney+).

- Sling TV: The company delivered its second price increase in its 5-year history in late 2019. Its Orange and Blue packages increased to $30 per month from $25 per month, while its combo package increased from $40 per month to $45 per month. Then in 2020 it increased prices again, this time to $35 per month for its Orange and Blue packages, and to $50 per month for its Orange+Blue package. At the end of 2022, this crept to $60 per month.

- Vidgo: Vidgo’s pricing history has been weird and chaotic since it first hit the scene in 2018. The base cost started at $39.99 for its English package, before dropping to $19.99 in 2019 when the company introduced a light package. Then the base price increased back up to $45 per month in 2020. As of 2023, the service costs $69.99 with some plans going as high as $99.99 per month.

Almost universally, these price increases were far from insignificant—especially for AT&T TV Now (now DirecTV Stream). That service increased its entry-point subscription price in 2019 by 30 percent compared to its price in 2018. Only the now-defunct PlayStation Vue service had more modest price increases across its packages. 거의 보편적으로 이러한 가격 인상은 그리 중요하지 않았습니다. 특히 AT&T TV Now(현재 DirecTV Stream)의 경우 더욱 그렇습니다. 이 서비스는 2019년에 진입점 구독 가격을 2018년 가격에 비해 30% 인상했습니다. 현재 없어진 PlayStation Vue 서비스만이 패키지 전반에 걸쳐 가격이 더 완만하게 인상되었습니다.

Meanwhile, Philo remained the lowest-cost major player despite a pseudo price increase. The company dropped its smaller and cheaper package in favor of a single-package option.

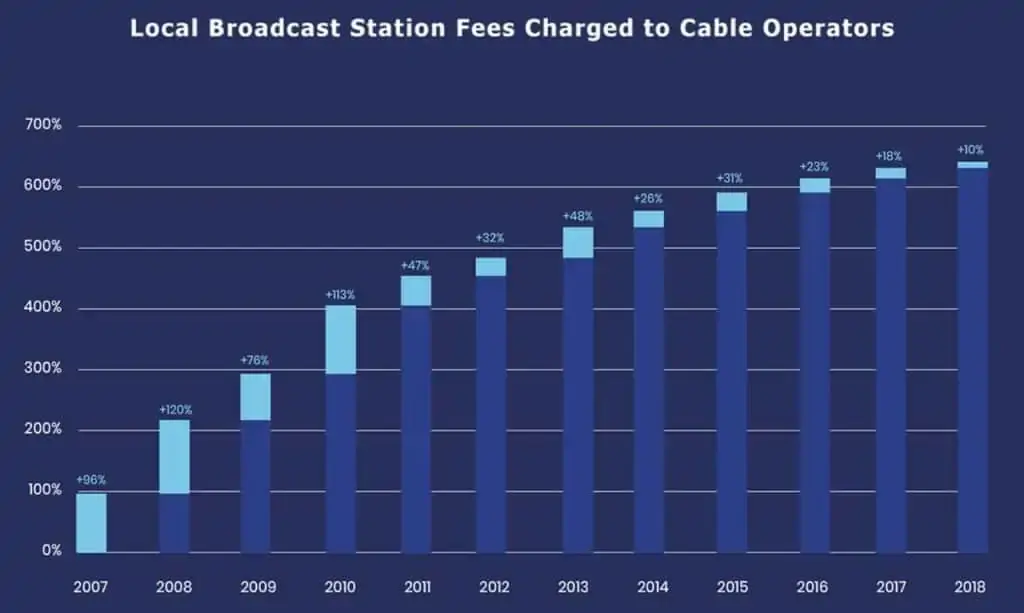

Price increases for these services are almost always tied to demands from the channel providers. Carriage fees are increasing for cord-cutting services and traditional cable TV services alike as the channel providers they offer (local broadcast networks, in particular) ask for more money. 한편, Philo는 가짜 가격 인상에도 불구하고 최저가 메이저 플레이어를 유지했습니다. 회사는 단일 패키지 옵션을 선호하여 더 작고 저렴한 패키지를 포기했습니다. 이러한 서비스의 가격 인상은 거의 항상 채널 제공업체의 요구와 관련이 있습니다. 코드커팅 서비스와 기존 케이블 TV 서비스 모두에서 제공하는 채널 제공업체(특히 지역 방송 네트워크)가 더 많은 비용을 요구함에 따라 운송료가 인상되고 있습니다.

In fact, local broadcast network fees are up over 600 percent since 2006, while all TV network fees (local, premium, and cable networks) are up around 90 percent since 2009.

7. AT&T TV is over 50% more expensive than its competitors on the high end

The slow plod toward higher streaming service prices has caused a fair amount of hand-wringing. Few services have received as much ire or backlash for this approach than AT&T. Its DirecTV to AT&T TV Now to AT&T TV to DirecTV Stream name changes were already enough to cause some frustration among customers. But its consistent and exceptionally high price increases have really put customers off the service, leading to the massive subscriber losses we’ve mentioned earlier. 더 높은 스트리밍 서비스 가격 향한 더딘움직임은 일정부분 긴장되어 발전이 주춤했습니다. AT&T만큼 이러한 접근 방식에 대해 많은 분노나 반발을 받은 서비스는 거의 없습니다. DirecTV에서 AT&T TV로, 이제 AT&T TV에서 DirecTV로의 스트림 이름 변경은 이미 고객들 사이에 약간의 불만을 야기하기에 충분했습니다. 그러나 일관되고 유난히 높은 가격 인상으로 인해 고객이 서비스를 중단하게 되었고, 앞서 언급한 대규모 가입자 손실로 이어졌습니다.

Based on our analysis, the company has consistently offered higher prices for its most expensive package since 2019.

You can use the table above to explore the data a bit further. When filtering by year, you’ll see that 2017 was a real break-out year for multi-channel streaming video providers hitting the market. And most, at that time, were still what we consider “middle cost” services with an entry point that was below $50 per month. 위의 표를 사용하여 데이터를 좀 더 자세히 살펴볼 수 있습니다. 연도별로 필터링하면 2017년은 다중 채널 스트리밍 비디오 제공업체가 시장에 뛰어든 획기적인 해라는 것을 알 수 있습니다. 그리고 당시 대부분의 서비스는 여전히 월 50달러 미만의 진입점을 갖춘 "중간가격대" 서비스였습니다. 언제

Starting in 2019, however, services began breaching the “high cost” $50+ range. AT&T was the worst offender on that end, as its highest-tier plan leaped 57% in price, from $75 to $135. Then, in 2020, its base package also dramatically jumped in price, from $50 per month to $65 per month, a 26% increase. It’s hardly any wonder why the company also saw a heavy subscriber bleed that year, as well. 그러나 2019년부터 서비스는 "고비용" $50+ 가격대를 넘기 시작했습니다. AT&T는 가장 높은 요금제 가격이 75달러에서 135달러로 57%나 뛰어올랐기 때문에 최악의 ott 공급자였습니다. 그러다가 2020년에는 기본 패키지 가격도 월 50달러에서 월 65달러로 26%나 급등했습니다. 회사가 그해에도 많은 가입자가 출혈하는 것을 본 이유는 전혀 놀라운 일이 아닙니다.

Our data also shows the dramatic difference between Philo and its competitors. The service continues to straddle between the “middle cost” and “low cost” range at $25 per month. 우리의 데이터는 또한 Philo와 경쟁사 간의 극적인 차이점을 보여줍니다. 이 서비스는 월 25달러로 계속해서 "중간 비용"과 "저비용" 사이를 오가고 있습니다.

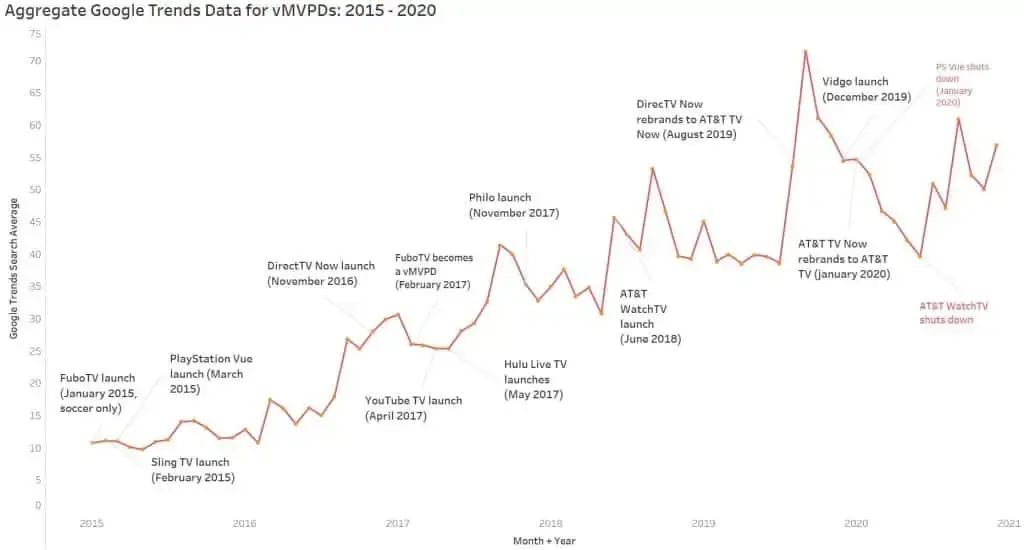

8. Search interest in vMVPDs is up 150% since 2015

Aggregated Google Trends data reveals that cord-cutters are increasingly interested in live TV streaming services, with no signs of stopping. In fact, aggregated search interest from 2015 to the end of 2020 for the 10 major vMVPDs to hit the market reveals search interest in these services was the highest it’s ever been in September 2019.

Sling TV was the first major cord-cutting service to launch on the market, offering an “a la carte” live TV model (although fuboTV preceded it by one month, but with a soccer-only streaming service). It was later followed by PlayStation Vue (also 2015). Meanwhile, 2017 was a breakout year for this niche as five out of the seven largest multi-channel streaming TV providers launched that year. The most recent major service launch was AT&T WatchTV, which entered the market in 2018. WatchTV was a direct response to the no-sports Philo.

Based on search trends, September appears to be when search interest in vMVPDs spikes, most likely due to this being the month the biggest services make major announcements or service changes.

Of the 10 major vMVPDs that have launched onto the US market since 2015, two have since gone out of business: PlayStation Vue and AT&T WatchTV.

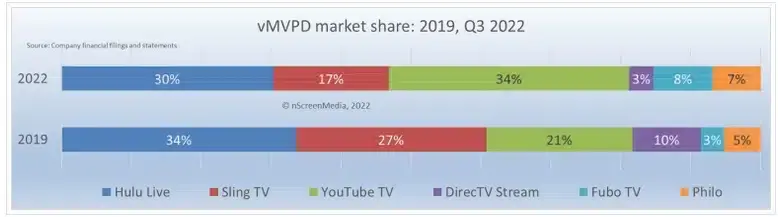

9. YouTube TV is now the most-searched vMVPD on the market

Sling TV’s place on the market, combined with its successful marketing campaigns, helped it dominate in the OTT space for most of the past five years. However, increased competition is now eating away at its market share. This is evidenced both by Sling TV’s slowing subscriber growth rate, as well as the negative search interest it’s experiencing on search engines. 성공적인 마케팅 캠페인과 결합된 Sling TV의 시장 입지는 지난 5년 동안 OTT 공간을 장악하는 데 도움이 되었습니다. 그러나 경쟁이 심화되면서 이제 시장 점유율이 잠식되고 있습니다. 이는 Sling TV의 가입자 증가율 둔화와 검색 엔진에서 겪고 있는 부정적인 검색 관심도 모두에서 입증됩니다.

The real breaking point for Sling TV appears to have been late October/early November 2017, or around six months after YouTube TV officially entered the market. Google soft-launched its YouTube TV service in only a handful of major cities but rapidly expanded the service area by the end of 2017. YouTube TV’s search interest finally reached a sustained dominance over Sling TV in January 2019, the same month Google officially announced that its YouTube TV service was available everywhere in the US. Sling TV의 실제 한계점은 2017년 10월 말~11월 초, 즉 YouTube TV가 공식적으로 시장에 진출한 지 약 6개월 후인 것으로 보입니다. Google은 소수의 주요 도시에서만 YouTube TV 서비스를 소프트 런칭했지만 2017년 말까지 서비스 영역을 빠르게 확장했습니다. YouTube TV의 검색 관심도는 마침내 2019년 1월에 Sling TV에 대한 지속적인 지배력에 도달했습니다. YouTube TV 서비스는 미국 전역에서 이용 가능했습니다.

While YouTube TV completely dominates this space, every other service is now clamoring for the #2 spot. Philo and FuboTV have seen their presence grow but better-known providers, such as Sling TV and Hulu are noticably smaller than a few years ago. YouTube TV가 이 공간을 완전히 장악하고 있는 반면, 다른 모든 서비스는 이제 2위 자리를 노리고 있습니다. Philo와 FuboTV는 그 존재감이 커졌지만 Sling TV, Hulu 등 잘 알려진 제공업체의 규모는 몇 년 전보다 눈에 띄게 작아졌습니다.

10. The on-demand streaming market is getting fierce—and overcrowded

Netflix is currently the biggest over-the-top (OTA) on-demand streamer available for cord-cutters. The company was the first to successfully deliver a real on-demand streaming experience to subscribers, giving it an edge over the growing number of competitors. By Q1 of 2023, Netflix had over 232.5 million subscribers worldwide.넷플릭스는 가장커다란 OTT 업체다. 이 회사는 가입자에게 가장 성공적으로 스트리밍서비스를 한 회사이고 더욱더 커지는 많은 경쟁자들중 가장 선두를 차지하고 있다. 2023년 1분기 넷플릭스는 2.3억 세계 가입자를 가지고 잇다.

Now, there are hundreds of on-demand streaming services crowding the market (more than 300), all competing for a limited number of subscribers. One study found 70 percent of consumers think there are too many choices on the market right now, which is not good news for new entrants. 수백의 스트리밍서비스가 존재하고 시장의 제한된 가입자를 위해 모두가 경쟁하고 있다. 이러한사실은 시장의 진입장벽을 위하여도 좋은 일은 아닐 듯...

The most notable new players include:

- Disney+: Launched November 12, 2019, in select countries, with worldwide launches scheduled through 2023

- Apple TV+: Launched November 1, 2019, worldwide

- AMC+: Launched June 2020, select countries

- HBO Max: Launched May 2020, available in most countries

- Discovery+: Launched March, 2020, select regions

- Peacock (NBC): Launched July 15, 2020

- Discovery+: Launched January 4, 2021

- HBO Max: Launched May 2020

- Quibi: Launched April 6, 2020

- Paramount+: Originally CBS All Access, rebranded and launched internationally in 2021.

Outside of this, cord cutting allows users to choose between over 100 different niche on-demand services. This market saturation has created what some observers are calling a streaming service bubble. When that bubble will burst, however, is difficult to predict. 이 외에도 코드 절단을 통해 사용자는 100개 이상의 다양한 틈새 주문형 서비스 중에서 선택할 수 있습니다. 이러한 시장 포화로 인해 일부 관찰자들은 스트리밍 서비스 버블이라고 부르는 현상이 발생했습니다. 그러나 언제 그 거품이 터질지는 예측하기 어렵습니다.

Currently, most Americans pay for multiple streaming services, with 88 percent subscribed to at least one. However, 19 percent have swapped to an ad-supported service in the last six months, with a full quarter cancelling a subscription outright to save money. This may also be part of why free, user-generated platforms like TikTok have become so popular.현재 대부분의 미국인은 여러 스트리밍 서비스에 비용을 지불하고 있으며 88%가 적어도 하나의 스트리밍 서비스에 가입하고 있습니다. 그러나 19%는 지난 6개월 동안 광고 지원 서비스로 전환했으며, 전체 분기는 비용을 절약하기 위해 구독을 완전히 취소했습니다. 이는 또한 TikTok과 같은 무료 사용자 생성 플랫폼이 인기를 얻은 이유 중 하나일 수 있습니다.

11. Cord cutters are attracted to original content

Companies like Netflix, Hulu, and HBO are in an arms race of sorts over original content. One analysis found that cord cutters are driven primarily by original content when they choose to subscribe to streaming services. However, as the State of Media and Entertainment 2023 notes: “a continued stream of content is required to retain and grow a subscriber base”. Netflix, Hulu, HBO와 같은 회사는 오리지널 콘텐츠를 놓고 일종의 군비 경쟁을 벌이고 있습니다. 한 분석에 따르면 코드 커터는 스트리밍 서비스 구독을 선택할 때 주로 원본 콘텐츠에 의해 움직인다는 사실이 밝혀졌습니다. 그러나 2023년 미디어 및 엔터테인먼트 현황에서는 "구독자 기반을 유지하고 확대하려면 지속적인 콘텐츠 스트림이 필요합니다"라고 언급했습니다.

12. On-demand streaming services respond by spending big on original content

The number of on-demand services in the market is helping to drive up original content spending budgets. Consumers are hungry for unique and original stories, and providers are trying to win subscribers by providing high-quality content consumers can’t find anywhere else. 시장에 있는 주문형 서비스의 수는 독창적인 콘텐츠 지출 예산을 늘리는 데 도움이 됩니다. 소비자는 독특하고 독창적인 스토리를 원하며, 제공업체는 소비자에게 다른 곳에서는 찾을 수 없는 고품질 콘텐츠를 제공하여 구독자를 확보하려고 노력하고 있습니다.

The biggest original content spenders include:

- Netflix: The company spent $17 billion on content in 2021 and plans to keep spending at this level for the next few years.

- Apple TV+: Apple is spending roughly $7 billion annually on original content.

- Disney+: In 2023, the company is expected to spend around $10.5 billion on original content, around $30 billion all in all.

- Peacock: Comcast expects to spend $5 billion on content in the next few years.

- Amazon Prime Video: Since 2018, Prime Video has tripled the number of Amazon originals. The exclusive show The Lord of the Rings: The Rings of Power is set to be the most expensive series ever produced, costing more than $1 billion, with the first season alone costing $462 million. In 2022 alone, it spent more than $16.6 billion on content.

- HBO/HBO Max: The company planned to spend $18 billion in 2022 in a bid to catch up with Netflix and Disney.

As providers deliver bigger budgets to their original content writers, cord-cutters are certainly benefiting even as they hit their breaking point for how many services they want to pay for.Unsurprisingly, password sharing is increasing as a result. Major services like Netflix and others are now considering cracking down on the practice. One study even puts the cost of password sharing on the streaming industry at $9.1 billion in lost potential revenue. 공급자가 원본 콘텐츠 작성자에게 더 많은 예산을 제공함에 따라 비용을 지불하려는 서비스 수에 대한 한계점에 도달하더라도 코드 커터는 확실히 이익을 얻고 있습니다. 결과적으로 비밀번호 공유가 증가하는 것은 당연합니다. Netflix와 같은 주요 서비스는 현재 이러한 관행을 단속하는 것을 고려하고 있습니다. 한 연구에 따르면 스트리밍 업계의 비밀번호 공유 비용으로 인해 잠재적 수익 손실이 91억 달러에 달하는 것으로 나타났습니다.

13. The COVID-19 pandemic caused a 72% decrease in top-rated Netflix content releases

Hollywood came to a grinding halt in 2020 as a result of the COVID-19 pandemic. We are just now starting to see the damage, and for Netflix’s release schedule, the damage was huge. The company has two types of content releases: TV shows and movies it produces and owns through its studios or through partners, and content it licenses from other copyright holders. As the pandemic set in and production halted, Netflix released 72% fewer TV shows and movies with high ratings (IMDb scores of 80% or more) from its own production cycle than it did in 2019. 2020년 할리우드는 코로나19 팬데믹으로 인해 멈췄다. 이제 막 피해가 보이기 시작했는데 넷플릭스의 출시 일정에 비해 피해는 엄청났다. 회사에는 두 가지 유형의 콘텐츠 출시가 있습니다. 스튜디오나 파트너를 통해 제작 및 소유하는 TV 프로그램과 영화, 그리고 다른 저작권 보유자로부터 라이센스를 받는 콘텐츠입니다. 팬데믹이 시작되고 제작이 중단됨에 따라 Netflix는 2019년보다 자체 제작 주기에서 높은 평가를 받은(IMDb 점수 80% 이상) TV 프로그램과 영화를 72% 더 적게 출시했습니다.

To note, Netflix has produced far more content than what our data shows. We included only TV shows and movies Netflix has released that earned a score of 8/10 or higher on IMDb. Since 2008, Netflix has produced 164 titles and licensed 67. Prior to the pandemic, Netflix was rapidly increasing the number of titles it produced. Covid-19 put a halt to that in a rather dramatic fashion. To keep the flow of content going, however, Netflix instead increased the number of titles it was licensing. The company licensed and released 12 high-rated TV shows and movies in 2020, compared to 9 in 2019. 참고로 Netflix는 데이터에 표시된 것보다 훨씬 더 많은 콘텐츠를 제작했습니다. IMDb에서 8/10 이상의 점수를 받은 Netflix가 출시한 TV 프로그램과 영화만 포함했습니다. 2008년부터 Netflix는 164개의 타이틀을 제작하고 67개의 라이선스를 취득했습니다. 팬데믹 이전에 Netflix는 제작하는 타이틀의 수를 빠르게 늘리고 있었습니다. 코로나19는 다소 극적인 방식으로 이를 중단시켰다. 그러나 콘텐츠의 흐름을 유지하기 위해 Netflix는 라이선스를 부여하는 타이틀 수를 늘렸습니다. 회사는 2019년 9개에 비해 2020년에는 12개의 높은 평가를 받은 TV 프로그램과 영화를 라이선스하고 출시했습니다.

See also: How to change Netflix region

Cord-cutting predictions for 2023 and beyond

There are some interesting trends to watch going forward. Here are five key predictions on the future of cord-cutting statistics:

- Larger media organizations will begin absorbing smaller streaming platforms or offering bundles of packages. This will begin with the HBO Max/Discovery+ merger and slowly become the norm. 대규모 미디어 조직은 소규모 스트리밍 플랫폼을 흡수하거나 패키지 번들을 제공하기 시작할 것입니다. 이는 HBO Max/Discovery+ 합병으로 시작되어 서서히 표준이 될 것입니다.

- Major streaming services will continue to phase out free trials and attempt to stop password sharing for good 수익성이 많이 악화되어 다중접속에 대한 원천적 차단 실행하고 있음

- “Free with ads” tiers will increase across on-demand streaming services 온디맨드 스트리밍서비스 광고로 무장된 무료서비스들이 증가할것

- The Vidgo live TV streaming service will either get purchased by a competitor or will completely shut down after failing to draw subscribers Vidgo라이브tv스트리밍서비스는 경쟁자들이 구매하거나 가입자 폭락사태로 폐쇄 될것이다.

- Apple TV+ will begin licensing content to boost its lackluster content library Apple TV+는 빈약한 콘텐츠 라이브러리를 강화하기 위해 콘텐츠 라이센스를 시작할 예정입니다.