The retail media market has come a long way since Amazon first launched its network in 2012. Since those early days, a broad range of retailers and other businesses have established their own retail media networks, from Walmart to Kroger, Tesco, Best Buy, Instacart and even Marriott. This has catalysed growth which is set to continue for the foreseeable future. GroupM has forecasted that retail media will reach $160bn in spend by 2027. In a changing and competitive market, and as the twilight of the third-party cookie looms, brands are seizing the growing opportunity offered by retail media. This abridged excerpt from the opening chapter of Econsultancy’s Retail Media Best Practice Guide, offers a definition of retail media, and reasons for its rapid growth. Econsultancy offers training in digital marketing and ecommerce, including in retail media.

소매 미디어 시장은 Amazon이 2012년에 네트워크를 처음 출시한 이후 많은 발전을 이루었습니다. 초기부터 Walmart에서 Kroger, Tesco, Best Buy, Instacart에 이르기까지 다양한 소매업체와 기타 기업이 자체 소매 미디어 네트워크를 구축했습니다. 그리고 심지어 메리어트. 이는 가까운 미래에도 계속될 성장을 촉진했습니다. GroupM은 2027년까지 소매 미디어 지출이 1,600억 달러에 이를 것으로 예상했습니다. 변화하고 경쟁이 치열한 시장에서, 그리고 제3자 쿠키의 종말이 다가옴에 따라 브랜드는 소매 미디어가 제공하는 성장하는 기회를 포착하고 있습니다. Econsultancy의 소매 미디어 모범 사례 가이드 첫 장에서 발췌한 이 요약 내용은 소매 미디어에 대한 정의와 급속한 성장의 이유를 제공합니다. Econsultancy는 소매 미디어를 포함하여 디지털 마케팅 및 전자 상거래에 대한 교육을 제공합니다.

What is retail media?

In its broadest sense, retail media relates to any promotional marketing placed by brands at or near the point of sale, whether that is in a physical store environment or on a retailer or ecommerce website. Technology and advertising business Criteo defines retail media as“…ads placed on a retailer’s ecommerce site or app by a brand in order to influence the customer at the point of purchase. Retail media enables brands to boost their visibility on the ‘digital shelf’, similar to an endcap or special in-aisle feature in a physical store.”

Retail media is most often bought by brands that are already selling goods on the retailer’s ecommerce site and may be looking to drive awareness and consideration but most notably to improve sales of their products. However, it may also be bought by other advertisers that are looking to reach certain types of consumers and that are using retail sites in much the same way as they would other types of media outlet. Research from Merkle found that 63% of retailers have non-seller brands that are actively using their media network. 가장 넓은 의미에서 소매 미디어는 실제 매장 환경, 소매업체 또는 전자상거래 웹사이트 등 판매 시점이나 그 근처에서 브랜드가 배치하는 모든 판촉 마케팅과 관련됩니다. 기술 및 광고 비즈니스 Criteo는 소매 미디어를 "...구매 시점에서 고객에게 영향을 미치기 위해 브랜드가 소매업체의 전자상거래 사이트나 앱에 게재하는 광고"로 정의합니다. 소매 미디어를 통해 브랜드는 실제 매장의 엔드캡이나 통로 내 특별한 기능과 유사한 '디지털 진열대'에 대한 가시성을 높일 수 있습니다."

A good definition of retail media… reflects the fact that it sits alongside other aspects of shopper marketing, and also enables advertising both on and off retailer sites. 소매 미디어에 대한 좋은 정의는 쇼핑객 마케팅의 다른 측면과 나란히 위치하며 소매업체 사이트 안팎에서 광고를 가능하게 한다는 사실을 반영합니다.

Retail media networks (RMNs) are the advertising platforms created by retailers that give brands access to promotional inventory across owned retailer channels. These platforms enable retailers to manage the placement of promotional formats on their owned media and may also facilitate advertisers making use of the retailer’s first-party data to target shoppers with relevant advertisements both on the retailer’s media and across the open web. Networks typically provide a range of formats, tools and methods to enable the placement of ads, and campaign reporting. 소매 미디어 네트워크(RMN)는 브랜드가 소유한 소매업체 채널 전반에 걸쳐 판촉 재고에 액세스할 수 있도록 소매업체가 만든 광고 플랫폼입니다. 이러한 플랫폼을 통해 소매업체는 자신이 소유한 미디어에서 판촉 형식의 배치를 관리할 수 있으며 광고주가 소매업체의 자사 데이터를 활용하여 소매업체의 미디어와 공개 웹 모두에서 관련 광고를 통해 쇼핑객을 타겟팅할 수 있습니다. 네트워크는 일반적으로 광고 게재 및 캠페인 보고를 가능하게 하는 다양한 형식, 도구 및 방법을 제공합니다.

A good definition of retail media, therefore, reflects the fact that it sits alongside other aspects of shopper marketing, and also enables advertising both on and off retailer sites.

Philippa Snare, SVP, EMEA, of The Trade Desk, explains retail media in the following terms:

“We think of ‘shopper marketing’ as an umbrella term covering the broader opportunity in retail, from physical in-store ads to product suggestions on online stores. Sitting underneath this is ‘on-site retail media’, which is any advertising taking place on the retailer’s own site. The final layer is arguably the most exciting offering, which is ‘off-site retail data’, where data is decoupled from the retailer’s own websites and apps to power and optimise advertising campaigns across the open internet.”

Marketing technology business Epsilon describes how using retailer first-party data can reach in-market buyers at the point of purchase, and how a successful retail media network “is one that can effectively monetize all addressable channels in a brand-safe, privacy-compliant environment – all the way through to the end consumer.”

따라서 소매 미디어에 대한 올바른 정의는 그것이 쇼핑객 마케팅의 다른 측면과 나란히 위치하며 소매업체 사이트 아나로그와 디지털 공간 모두에게서 광고를 가능하게 한다는 사실을 반영합니다. The Trade Desk의 EMEA SVP Philippa Snare는 소매 미디어를 다음과 같은 용어로 설명합니다. “우리는 '쇼퍼 마케팅'을 실제 매장 내 광고부터 온라인 매장의 제품 제안에 이르기까지 소매업에서 더 넓은 기회를 포괄하는 포괄적인 용어로 생각합니다. 그 밑에는 소매업체 자체 사이트에서 진행되는 모든 광고인 '현장 소매 미디어'가 있습니다. 마지막 계층은 틀림없이 가장 흥미로운 제품인 '오프사이트 소매 데이터'입니다. 여기서 데이터는 소매업체의 자체 웹사이트 및 앱에서 분리되어 개방형 인터넷에서 광고 캠페인을 강화하고 최적화합니다."

마케팅 기술 비즈니스 Epsilon은 소매업체 자사 데이터를 사용하여 구매 시점에 시장 내 구매자에게 도달하는 방법과 성공적인 소매 미디어 네트워크가 "브랜드가 안전하고 개인정보 보호를 준수하는 방식으로 모든 주소 지정 가능한 채널에서 효과적으로 수익을 창출할 수 있는 네트워크"에 대해 설명합니다. 환경 – 최종 소비자에게 이르기까지 모든 과정을 거쳐야 합니다.”

What is driving retail media growth?

McKinsey research has revealed that 87% of CPGs (a category that are significant retail media spenders) planned to increase their ad spend in retail media networks in 2023. Interestingly, 70% of the respondents in McKinsey’s survey said that this was because their ad performance in retail media (in driving product sales) is significantly or somewhat better than in other channels.Research by The Trade Desk demonstrated that 74% of brands now have dedicated budgets for retail media networks, and IAB Europe data indicates that 92% of advertisers are actively partnering with retailers to reach consumers through retail media. McKinsey 연구에 따르면 CPG Consumer Packaged Goods(소매 미디어에 상당한 지출을 하는 카테고리)의 87%가 2023년에 소매 미디어 네트워크에서 광고 지출을 늘릴 계획인 것으로 나타났습니다. 흥미롭게도 McKinsey 설문조사 응답자 중 70%는 이것이 광고 성과 때문이라고 답했습니다. 소매 미디어(제품 판매 촉진)는 다른 채널보다 상당히 또는 다소 우수합니다. The Trade Desk의 조사에 따르면 현재 브랜드의 74%가 소매 미디어 네트워크에 대한 전용 예산을 갖고 있으며 IAB 유럽 데이터에 따르면 광고주의 92%가 소매업체와 적극적으로 협력하여 소매 매체를 통해 소비자에게 다가갑니다.

Growth in retail media has been supercharged by the convergence of several key drivers that have combined in a perfect storm:

- Pressure on retailers to derive new sources of revenue and improve margins.

- The ongoing challenge for brands to drive increasing sales in low-growth and ever-more competitive markets.

- The demise of third-party cookies and the need for brands to evolve their approaches to targeting consumers.

- Evolving consumer online behaviour which is impacting how shoppers are making product decisions.

소매 미디어의 성장은 완벽한 폭풍으로 결합된 여러 핵심 동인의 융합으로 인해 더욱 가속화되었습니다.

소매업체에 새로운 수익원을 창출하고 마진을 개선하라는 압력이 가해졌습니다.

저성장과 경쟁이 더욱 치열해지는 시장에서 브랜드의 매출 증대를 촉진하기 위한 지속적인 과제입니다.

제3자 쿠키의 종말과 브랜드가 소비자 타겟팅에 대한 접근 방식을 발전시켜야 할 필요성.

쇼핑객이 제품을 결정하는 방식에 영향을 미치는 진화하는 소비자 온라인 행동.

1. Pressure on retailers

According to research by analyst firm Alvarez & Marsal, European retail market profitability has been under particular pressure since 2015, with pre-tax profit margins falling from 6.4% in 2015/16 to 4.5% in 2019/20. The research further notes that the shift towards online shopping is a ‘significant contributing factor to dwindling profit margins’, with a correlation between rising proportion of sales from online channels and falling profit margins. This pattern is echoed in the US, where the Salesforce Shopping Index (based on shopping data from over a billion consumers worldwide) indicated that rising costs during the 2022 holiday shopping season was putting 10% of retailer profits at risk. This pressure on margins has intensified more recently as retailers face into the headwinds of high inflation and rising interest rates. In a number of markets this has been compounded by weak consumer demand and increased competition from low-margin, low-cost retailers (including Amazon and agile ecommerce retailers such as Shein as well as grocery businesses such as Lidl and Aldi). 조사분석회사 Alvarez & Marsal에 따르면, 세전 이익률은 2015~16년 6.4%에서 2019/20년 4.5%로 하락했습니다. 이 연구는 또한 온라인 쇼핑으로의 전환이 '이윤폭 감소에 중요한 기여 요인'이며, 온라인 채널의 판매 비중 증가와 이윤과 하락 사이의 상관관계를 지적합니다. 이러한 패턴은 미국에서도 반영됩니다. Salesforce 쇼핑 지수(전 세계 10억 명이 넘는 소비자의 쇼핑 데이터를 기반으로 함)에 따르면 2022년 연휴 쇼핑 시즌 동안 비용 상승으로 인해 소매업체 수익이 10% 위험에 처하게 되었습니다. 마진에 대한 이러한 압박은 최근 소매업체들이 높은 인플레이션과 금리 상승이라는 역풍에 직면하면서 더욱 강화되었습니다. 여러 시장에서 이는 약한 소비자 수요와 저마진, 저비용 소매업체(Amazon, Shein과 같은 민첩한 전자상거래 소매업체, Lidl 및 Aldi와 같은 식료품 기업 포함)와의 경쟁 심화로 인해 더욱 악화되었습니다.

For a retailer running their core business on a 2-4% margin, the prospect of setting up a retail media business that could run at [a] 40% margin is pretty appealing. – Julie Jeancolas, Dunnhumby 2~4%의 마진으로 핵심 비즈니스를 운영하는 소매업체의 경우 40%의 마진으로 운영될 수 있는 소매 미디어 비즈니스를 설립한다는 전망은 꽤 매력적입니다. – 줄리 진콜라스(Dunnhumby)

The squeeze on margins has given impetus to retailers looking for new sources of revenue, and retail media is seen as an opportunity to drive both incremental revenue and to improve margins. In a VideoWeek podcast, report interviewee Julie Jeancolas, Global Head of Product, Strategy and Partnerships, Retail Media and Personalisation, at Dunnhumby, highlighted the attractiveness of higher margin retail media: “For a retailer running their core business on a 2 to 4% margin, the prospect of setting up a retail media business that could run at [a] 40% margin is pretty appealing.”

마진의 압박은 새로운 수익원을 찾는 소매업체에 자극을 주었으며, 소매 미디어는 수익 증대와 마진 개선을 모두 촉진할 수 있는 기회로 간주됩니다. VideoWeek 팟캐스트에서 Dunnhumby의 제품, 전략, 파트너십, 소매 미디어 및 개인화 부문 글로벌 책임자인 Julie Jeancolas는 인터뷰 대상자로서 마진이 높은 소매 미디어의 매력을 다음과 같이 강조했습니다. 40%의 마진으로 운영될 수 있는 소매 미디어 사업을 설립할 수 있다는 전망은 매우 매력적입니다.”

2. The search for brand growth

Many brands operating in low-growth markets are facing a heightened challenge, which has placed more focus on developing new sources for driving sales. This growth challenge has been compounded by a higher level of competition in many categories, and more recently from weakening demand due to the high cost of living and inflation. PwC’s 2023 Global Consumer Insights Pulse Survey, for example, found that 96% of respondents intended to adopt cost-saving behaviours over the next six months, and that 69% of consumers had changed non-essential spending in the past six months. 저성장 시장에서 활동하는 많은 브랜드는 판매 촉진을 위한 새로운 소스 개발에 더 중점을 두면서 더 큰 도전에 직면해 있습니다. 이러한 성장 과제는 여러 분야에서 경쟁이 심화되고, 최근에는 높은 생활비와 인플레이션으로 인한 수요 약화로 인해 더욱 악화되었습니다. 예를 들어 PwC의 2023년 글로벌 소비자 인사이트 펄스 설문조사(Global Consumer Insights Pulse Survey)에 따르면 응답자의 96%가 향후 6개월 동안 비용 절감 행동을 채택할 의사가 있었고 소비자의 69%는 지난 6개월 동안 필수적이지 않은 지출을 변경한 것으로 나타났습니다.

These headwinds have perhaps been felt more keenly in the CPG category. McKinsey research found that between 2009 and 2019, for the top 30 CPGs, margin expansion contributed twice as much value as growth (50% versus 26%).

Growth for larger CPG brands has been particularly challenging, with the McKinsey research showing that from 2017–2019, 90% of overall value growth for the top CPG companies came from their small and medium-sized brands. In this low-growth environment, the opportunity is for brands to drive incremental sales by partnering with retailers in new ways to capitalise on the emerging retail media market.

3. Evolution in ad targeting

The decline in the value and use of third-party cookies in consumer targeting and advertising is also acting as a catalyst for retail media growth and the data-rich targeting opportunity that it provides.

The ability to use retailer first-party transactional and behavioural data is a significant opportunity for advertisers and brands that are looking to engage consumers in the most relevant way to drive conversion. Retail media also provides a form of data targeting that is far less reliant on mechanics that have been at the centre of privacy concerns such as cookies. As the demise of cookies gains momentum, this will place even greater emphasis on the value of retail media targeting opportunities.

이러한 역풍은 아마도 CPG 카테고리에서 더욱 예리하게 느껴질 것입니다. McKinsey 연구에 따르면 2009년부터 2019년 사이 상위 30개 CPG에서 마진 확대가 성장보다 두 배 더 많은 가치에 기여한 것으로 나타났습니다(50% 대 26%).

대형 CPG 브랜드의 성장은 특히 어려웠습니다. McKinsey 조사에 따르면 2017~2019년 상위 CPG 기업의 전체 가치 성장 중 90%가 중소 브랜드에서 나온 것으로 나타났습니다. 이러한 저성장 환경에서 브랜드는 신흥 소매 미디어 시장을 활용하기 위해 새로운 방식으로 소매업체와 협력하여 판매 증가를 촉진할 수 있는 기회입니다.

4. Consumer behaviour

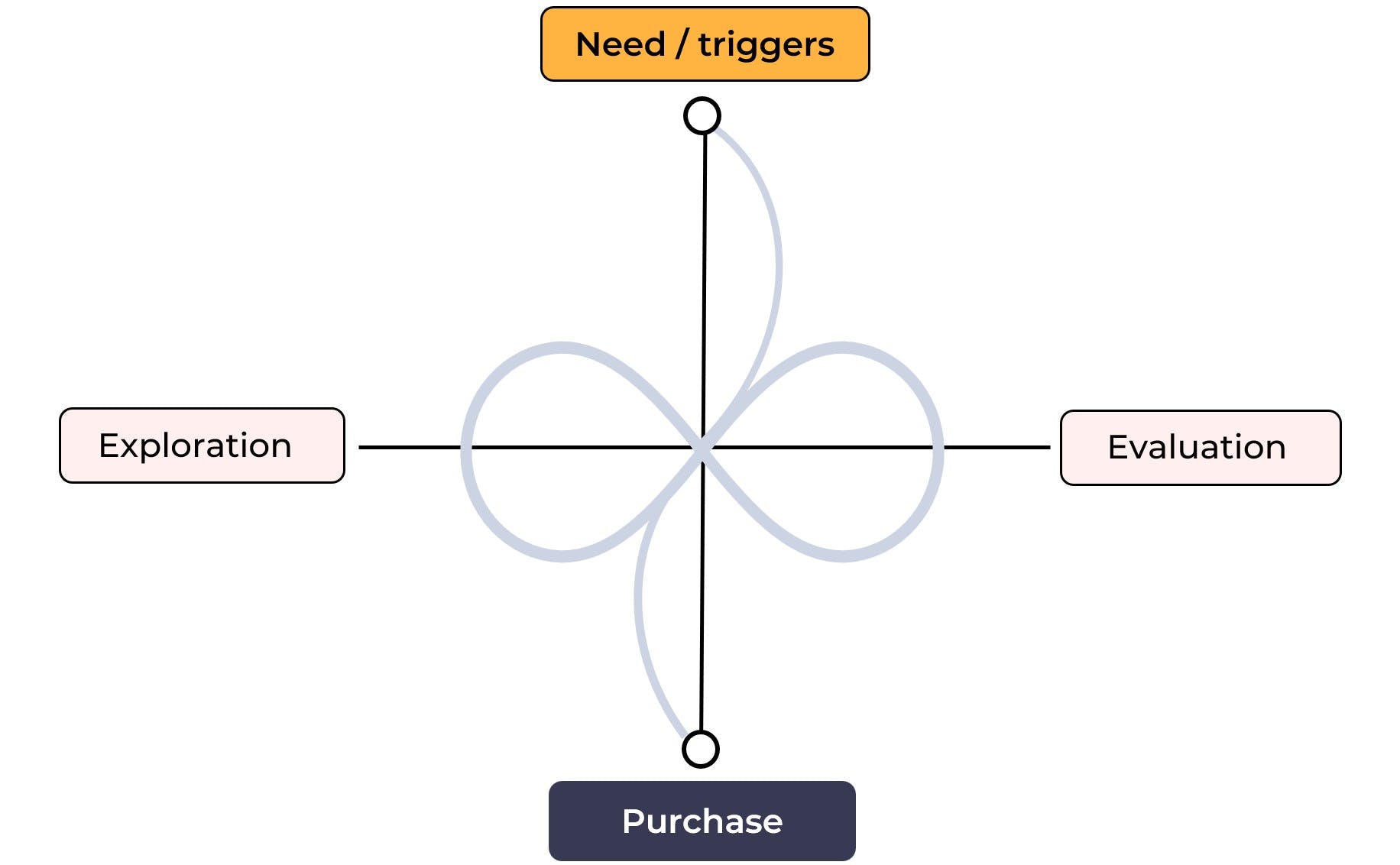

In consumer research into how people decide what to buy, Google has described the ‘messy middle’ that happens between trigger and purchase, and which is the space in which brands win or lose. Noting how digital touchpoints have become critical as sources of expertise, information and recommendation to inform purchases within a category, Google outlines how this messy middle is dominated by two mental modes: exploration, which is an expansive mode related to seeking out options and information, and evaluation, which is a reductive activity in which people narrow their choices.

사람들이 무엇을 구매할지 결정하는 방식에 대한 소비자 조사에서 Google은 트리거와 구매 사이에서 발생하는 '복잡한 중간', 즉 브랜드가 승패를 결정하는 공간을 설명했습니다.

카테고리 내에서 구매를 알리기 위한 전문 지식, 정보 및 권장 사항의 소스로서 디지털 터치포인트가 어떻게 중요해졌는지에 대해 Google은 이 지저분한 중간이 두 가지 정신 모드에 의해 어떻게 지배되는지 설명합니다. 탐색은 옵션과 정보를 찾는 것과 관련된 확장 모드입니다. 평가는 사람들이 선택의 범위를 좁히는 환원적 활동입니다.

The messy middle frames a context in which brands need to promote mental availability across digital and non-digital touchpoints and ensure the brand is front of mind while consumers explore but also that the gap between trigger and purchase is kept as close as possible to lessen consumer exposure to competitor brands or propositions. Retail media is playing an increasingly important role in achieving these objectives for brands. 구매 여정 의사결정 과정에서 Google의 '복잡한 중간'입니다. 출처: Econsultancy, Google 모델 기반. 지저분한 중간 프레임은 브랜드가 디지털 및 비디지털 접점 전반에 걸쳐 정신적인 가용성을 촉진하고 소비자가 탐색하는 동안 브랜드가 가장 먼저 떠오르도록 해야 하지만, 유발 요인과 구매 사이의 격차를 최대한 가깝게 유지하여 소비자의 구매 경험을 줄여야 하는 맥락을 제시합니다. 경쟁 브랜드 또는 제안에 대한 노출. 소매 미디어는 브랜드의 이러한 목표를 달성하는 데 점점 더 중요한 역할을 하고 있습니다.

At the same time, as customer journeys become more complex, the sources of recommendation and discovery for products that may fulfil consumer needs are evolving as well. An important shift in consumer behaviour here is the growing significance of online retailers as destinations for consumers to conduct their product searches, as opposed to Google and other search engines.

According to 2020 research undertaken by Criteo in the US, two thirds of online product searches start on retailer sites. This behaviour is also reflected in research conducted by software business InRiver (based on a survey of 6,000 adults in the US, UK and Germany), which found that 44% of product searches begin on marketplaces such as Amazon. This compares to 19% that start on a search engine and only 9% that begin on a brand’s own website. These shifts in behaviour are generating more opportunities for brands to reach consumers in compelling ways through emerging retail media channels.

구매 과정 의사 결정 과정에서 Google의 '복잡한 간략한'입니다. 출처: Econsultancy, Google 모델 기반.

접점한 작은 프레임은 유명인이 디지털 및 디지털 방식으로 접촉할 수 있는 능력 있는 가용성을 촉진하고 소비자가 탐색하는 동안 가장 먼저 하야하도록 해야 합니다. 노력해야 할 시간을 할당합니다. 축하합니다. 소매 미디어는 브랜드의 목표를 달성하는 데 점점 더 중요한 역할을 하고 있습니다.